how much is virginia inheritance tax

Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. Virginia Income Tax Calculator 2021.

Virginia Estate Tax 581-900.

. Today Virginia no longer has an estate tax or inheritance taxPrior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. With the elimination of. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

Your average tax rate is 1198 and your marginal tax rate is. Generally Virginia does not require an estate tax return unless there is a federal estate tax return due. How do you avoid inheritance tax.

How much can you inherit without paying taxes in virginia. 15 best ways to avoid inheritance tax in 2020. Tax Rate Estate Size.

Beyond those levels the first 1 million is taxed at rates from 18 to 39 with excess amounts rapidly hitting the 40 maximum tax threshold. Today Virginia no longer has an estate tax or inheritance tax. But just because Virginia does not have an.

The federal estate tax is due nine months from the date of death and is currently filed. State estate or inheritance. Pennsylvania does charge an inheritance and estate tax in some cases.

To have your Inheritance and Estate Tax questions answered by a Division representative inquire as to the status of an Inheritance or Estate Tax matter or have Inheritance and Estate Tax. Virginia Inheritance and Gift Tax. This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381.

2 Give money to family members and friends. The tax rate varies. This is great news for Virginia residents.

The top estate tax rate. Unlike the federal government Virginia does not have an estate tax. Like California and Texas do have an estate or inheritance tax.

The top estate tax rate is 16 percent exemption threshold. If you make 70000 a year living in the region of Virginia USA you will be taxed 12100. 1- Make a gift to your partner or spouse.

Virginia estate tax.

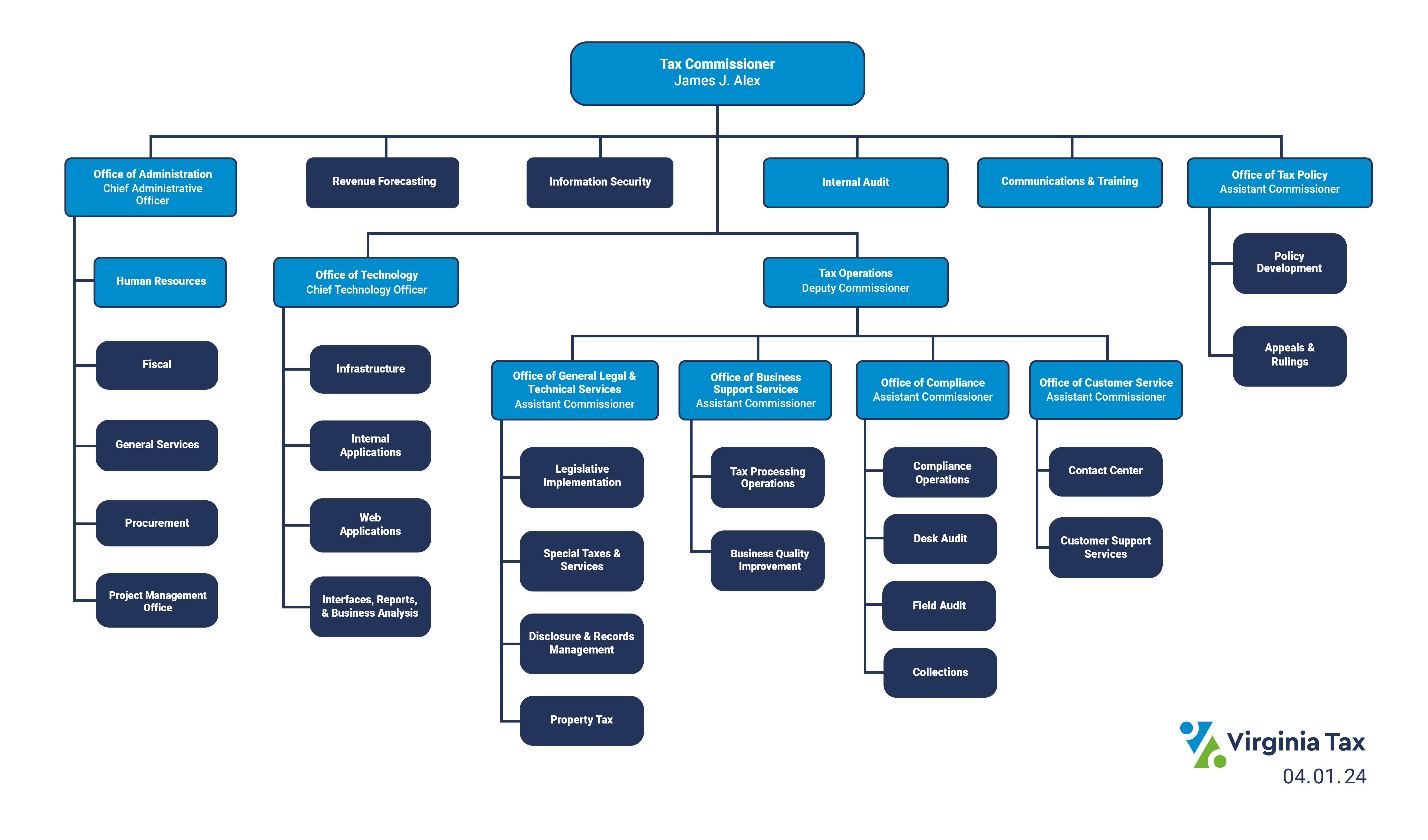

Estate Planning Essentials Probate Issues Virginia Cpa

Virginia Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

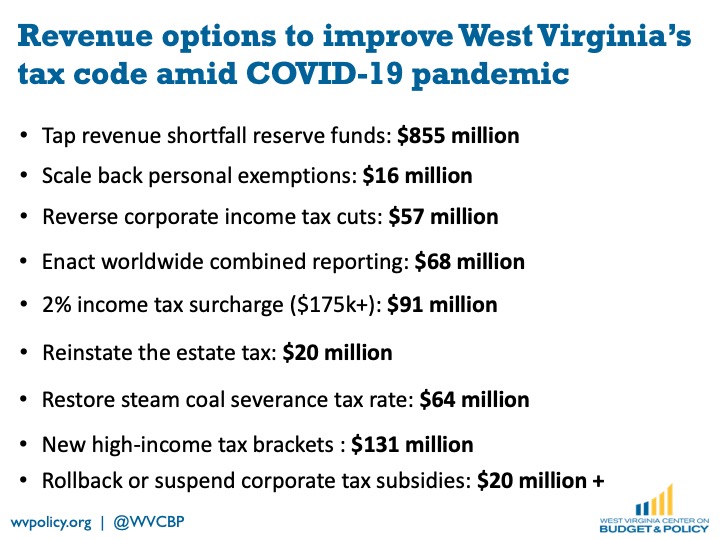

Tap Reserves And Enact Progressive Tax Policy To Address Covid 19 Economic Crisis West Virginia Center On Budget Policy

Estate Taxes They Re Not Dead Yet C Douglas Welty Plc

Virginia Sales Tax Holiday Virginia Tax

State Estate And Inheritance Taxes Itep

Maryland Raises Estate Tax Exemption Wealth Management

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

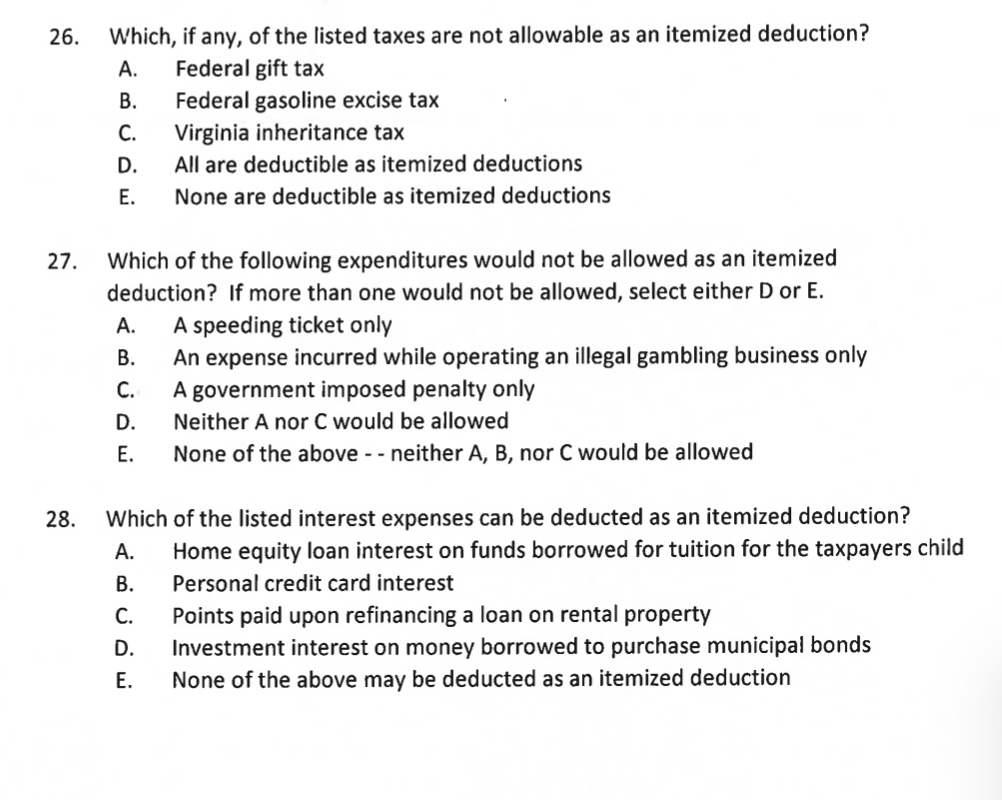

Solved 26 Which If Any Of The Listed Taxes Are Not Chegg Com

West Virginia Estate Tax Everything You Need To Know Smartasset

The Wealthy Now Have More Time To Avoid Estate Taxes

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Inheritance Law In Virginia Jdkatz P C

Estate And Inheritance Taxes By State In 2021 The Motley Fool